In today’s rapidly evolving financial landscape, digital banking has emerged as a cornerstone of modern financial services, offering unparalleled convenience and accessibility to customers worldwide. Bank Islami App, a pioneer in Pakistan’s Islamic banking sector, has embraced this digital transformation by introducing its state-of-the-art mobile application. This app not only aligns with the principles of Shariah-compliant banking but also integrates cutting-edge technology to provide a seamless and secure banking experience.

A New Era of User Experience

The Bank Islami App is meticulously designed to cater to the diverse needs of its users, ensuring that both tech-savvy individuals and those new to digital banking can navigate the platform with ease. The app’s intuitive interface presents a clean and organized layout, allowing users to access various banking services without unnecessary complexity. This thoughtful design reflects Bank Islami’s commitment to making digital banking accessible to all segments of society.

Comprehensive Account Management

At the core of the Bank Islami App is its robust account management system. Users can effortlessly monitor their account balances in real-time, review detailed transaction histories, and manage multiple accounts from a single dashboard. This feature empowers customers to stay informed about their financial activities, facilitating better financial planning and decision-making.

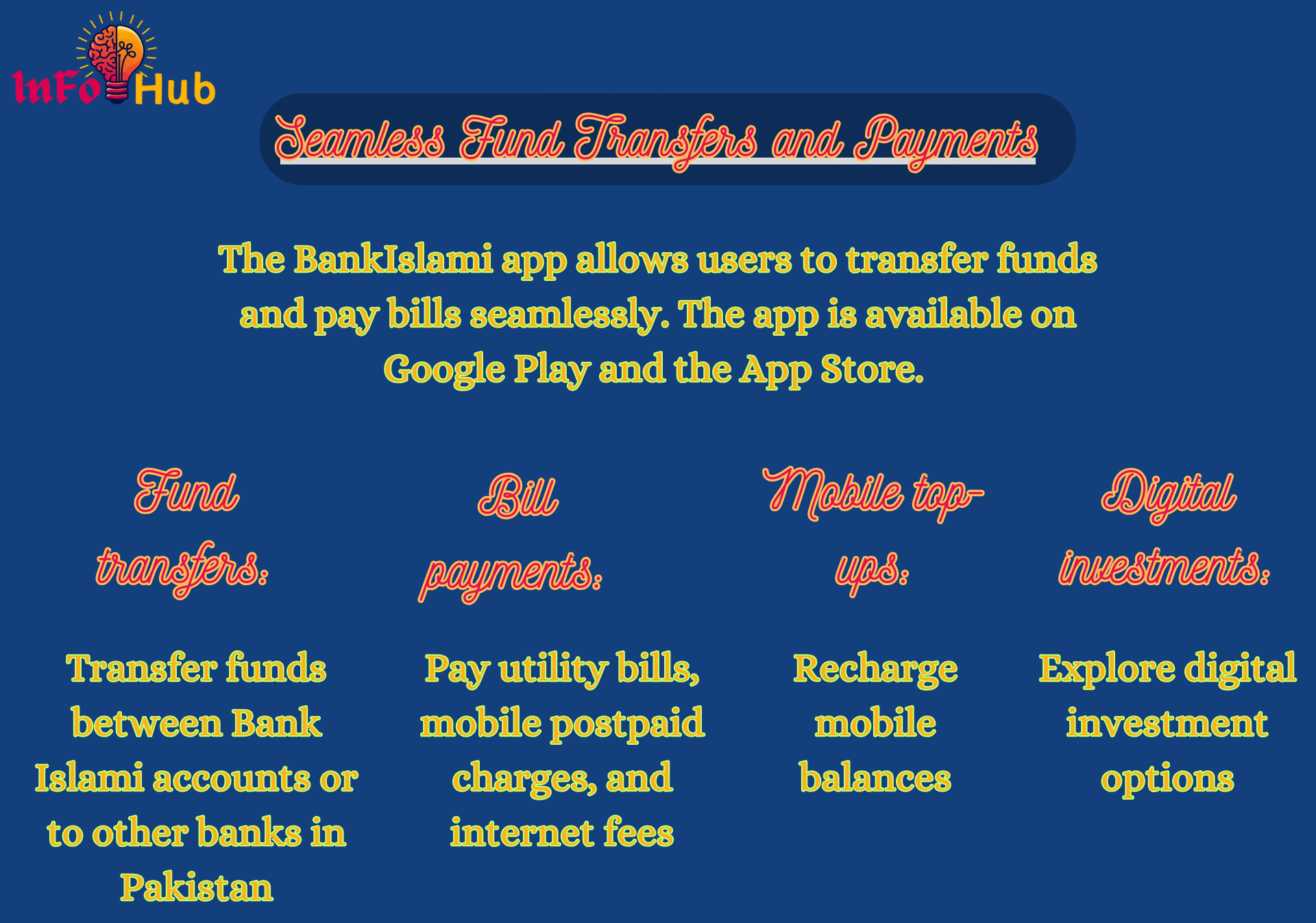

Seamless Fund Transfers and Payments

The Bank Islami app allows users to transfer funds and pay bills seamlessly. The app is available on Google Play and the App Store.

- Fund transfers: Transfer funds between Bank Islami accounts or to other banks in Pakistan

- Bill payments: Pay utility bills, mobile postpaid charges, and internet fees

- Mobile top-ups: Recharge mobile balances

- Digital investments: Explore digital investment options

These functionalities ensure that users can conduct their financial transactions efficiently, whether it’s sending money to family or paying for goods and services.

Enhanced Security Measures

Security is a paramount concern in digital banking, and the Bank Islami App incorporates advanced security protocols to protect user data and transactions:

- Biometric Verification: The app utilizes fingerprint and thumb scanning for user authentication, adding a robust layer of security.

- Mobile App Root Detection: This feature prevents the app from running on compromised devices, safeguarding against potential security breaches.

- Secure Registration Process: New users undergo a comprehensive verification process, including NADRA biometric verification, ensuring that only authorized individuals can access the app.

These measures reflect Bank Islami’s dedication to providing a secure banking environment for its customers.

Device and Account Management

The app offers flexible device management options, allowing users to designate primary and secondary devices for account access. This feature provides added convenience for customers who use multiple devices. Additionally, users have the autonomy to register or delete their accounts as needed, giving them full control over their digital banking experience.

Integration with iOS Features

For iOS users, the app integrates seamlessly with native features such as Face ID, offering quick and secure access. This integration enhances the user experience by leveraging the device’s built-in security capabilities.

Comprehensive Support and Resources

Bank Islami ensures that users have access to comprehensive support and resources to maximize their app experience:

- Step-by-Step Guides: The app includes detailed instructions for various processes, such as account creation and biometric verification, assisting users at every step.

- Customer Support: For personalized assistance, users can contact the Bank Islami support team via phone or email, ensuring that help is readily available when needed.

Future Prospects and Enhancements in the Bank Islami App

The Bank Islami App is continuously evolving to meet the growing needs of its customers in the digital banking space. With the increasing reliance on mobile banking, the bank is committed to enhancing the app with additional features that provide greater convenience, security, and efficiency. Future updates are expected to introduce advanced functionalities such as AI-powered customer support, predictive analytics for financial planning, and enhanced personalization options tailored to individual user preferences.

Artificial Intelligence and Chatbot Integration

To improve customer service and provide instant support, Bank Islami is considering the integration of an AI-powered chatbot within the app. This chatbot would be able to assist users with basic queries, guide them through various banking processes, and provide real-time updates on transactions, account status, and product offerings. By incorporating machine learning algorithms, the chatbot would become smarter over time, improving its ability to understand and respond to customer inquiries more efficiently.

Predictive Analytics for Financial Management

A significant enhancement in future updates could be predictive analytics, which would allow users to analyze their spending habits and receive personalized financial insights. This feature could categorize transactions, highlight spending patterns, and even offer budgeting suggestions based on past transactions. Users would benefit from a better understanding of their financial health, helping them make informed decisions about savings, investments, and daily expenses.

Expanded Bill Payments and E-Commerce Integration

While the Bank Islami App already allows users to pay utility bills and make merchant payments, future updates may introduce direct integration with major e-commerce platforms, enabling seamless online shopping experiences. Users would be able to pay for goods and services directly from their Bank Islami accounts without relying on third-party payment gateways. This would not only enhance security but also streamline the checkout process for online purchases.

Investment and Savings Management

As an Islamic bank, Bank Islami follows Shariah-compliant investment and savings principles. Future updates to the app might include features that allow users to explore and manage Islamic investment opportunities, such as Mudarabah (profit-sharing accounts) and Sukuk (Islamic bonds). The ability to track investment performance and receive financial growth insights would encourage customers to engage in Islamic finance more actively.

Customer Feedback and Continuous Improvement

See Also VPN Mod APK

Bank Islami Pakistan Limited uses customer feedback to improve its services and app. You can provide feedback by filling out a form at a branch or by calling 021-111-ISLAMI (475264).

How can I provide feedback?

- Fill out a customer feedback form at a branch

- Call 021-111-ISLAMI (475264)

- Email bankislami.official@gmail.com

How does Bank Islami use customer feedback?

- BankIslami uses customer feedback to improve its services and app

- BankIslami’s team is constantly working on supporting more use cases and devices

Compliance with Regulatory Standards

In the rapidly evolving digital banking environment, regulatory compliance is crucial for maintaining trust and security. Bank Islami ensures that its mobile app adheres to the highest security standards and complies with regulations set by the State Bank of Pakistan (SBP) and other financial authorities.

- Data Protection Laws: The app follows strict data protection policies to safeguard users’ personal and financial information.

- Shariah Compliance: Every financial product and feature introduced in the app is reviewed by Shariah scholars to ensure compliance with Islamic banking principles.

- Fraud Prevention Measures: Advanced fraud detection systems are in place to prevent unauthorized access and suspicious transactions.

Growing Popularity and Market Expansion

With a rising number of customers embracing digital banking, the Bank Islami App has seen substantial growth in its user base. The app’s ease of use, security, and diverse features make it a preferred choice for customers seeking a Shariah-compliant digital banking solution.

To further expand its reach, Bank Islami is actively working on enhancing its digital presence, introducing multi-language support, and launching localized banking solutions for overseas Pakistanis. These initiatives will strengthen the bank’s position in both domestic and international markets.

FAQ’s About Bank Islami App

What is the Bank Islami App?

The Bank Islami App is a digital banking application that allows customers to manage their accounts, transfer funds, pay bills, check balances, and perform other banking activities using their smartphones. The app follows Shariah-compliant principles and ensures a secure and convenient banking experience.

How can I download the Bank Islami App?

You can download the Bank Islami App from:

Google Play Store (for Android users)

Apple App Store (for iOS users)

Simply search for “Bank Islami App” and click on the install button.

How do I register on the Bank Islami App?

To register for the app, follow these steps:

1. Download and install the app from the Google Play Store or Apple App Store.

2. Open the app and select the “New User Registration” option.

3. Enter your CNIC number and account details to verify your identity.

4. Set up a secure password and PIN for login.

5. Complete the OTP verification (sent to your registered mobile number).

6. Login to the app and start using its features.

What services can I access through the Bank Islami App?

The app provides a variety of banking services, including:

✅ Account Management – View account balance, mini statements, and transaction history.

✅ Fund Transfers – Transfer money between your own accounts, to other BankIslami accounts, or to other banks via IBFT (Interbank Funds Transfer).

✅ Bill Payments – Pay utility bills, mobile top-ups, and other payments.

✅ Cheque Management – Request new chequebooks and stop cheque payments.

✅ Debit Card Services – Activate, block, or replace your debit card.

✅ Investment & Savings – View and manage Islamic investment accounts.

✅ QR Code Payments – Make quick payments via QR code scanning.

Is the Bank Islami App secure?

Yes, the app follows advanced security measures to ensure the protection of user data and transactions. Some key security features include:

🔒 Multi-Factor Authentication (MFA) – OTP verification for every major transaction.

🔒 Biometric Login – Users can enable fingerprint or facial recognition for extra security.

🔒 End-to-End Encryption – Data is encrypted to prevent unauthorized access.

🔒 Fraud Detection Systems – The bank continuously monitors transactions for suspicious activity.

What should I do if I forget my password?

If you forget your Bank Islami App password, follow these steps:

Open the app and click on “Forgot Password”.

Enter your registered CNIC number and follow the instructions.

An OTP (One-Time Password) will be sent to your registered mobile number.

Enter the OTP and create a new secure password.

If you are unable to reset your password, contact Bank Islami customer support for assistance.

Conclusion

The Bank Islami App stands as a testament to the bank’s commitment to innovation, security, and customer-centric services. By integrating advanced features and maintaining a user-friendly interface, Bank Islami provides a digital banking solution that meets the evolving needs of its customers while adhering to the principles of Islamic banking. As the financial landscape continues to evolve, Bank Islami remains at the forefront, delivering secure, efficient, and Shariah-compliant banking solutions through its mobile application.